August 2025 Market Update: Logic Is Optional: Why Markets Often Defy The Numbers

- jbrowning08

- Aug 1, 2025

- 6 min read

August 1, 2025

John Browning, MBA and CSA® | CEO, Principal

Ever try fixing your TV by just hitting the remote harder?

It worked in the '80's . . . . sometimes. But today? That flat screen’s connected to five streaming apps, a soundbar, and Wi-Fi that requires a software update to change the input.

What used to be simple... isn’t.

And that’s the trap investors fall into, trying to make sense of markets with quick, linear logic.

“Tariffs are up? Prices should be up too.

“Earnings are strong? Stocks should rise.”

But just like your smart TV, today’s market is a web of tangled inputs. And pressing harder on the remote won’t fix it.

Investors look to corporate earnings for clues about how businesses are performing; This earnings season is no different, however, many are looking to see if new tariffs are showing up in the earnings reports. Interestingly, they are not. Nor are they showing up the way many feared in consumer spending, drastically higher inflation, or anywhere else.

With the average effective tariff rate of 20.2% as of July 23, the highest level since 1911.1

Many are wondering where the increases have gone. With just over a third of S&P 500 companies having reported earnings results for the second quarter, 80% have delivered positive earnings-per-share surprises, and the blended earnings growth rate of 6.4% exceeded expectations of 4.9%, according to FactSet.2

Stock prices have moved contrary to the positive or negative earnings news consistently this earnings season.

Corporate earnings are beating expectations so far

So where are the increased tariffs going? The answer lies in the fact that many of the tariffs were never actually applied, and the complexity of the deals, the numbers behind the headlines, have resulted in a somewhat overall averaging out of expenses. We may yet see adverse impacts going forward, but so far, the effect has been paltry.

So why are stock prices seemingly moving in the opposite direction to the earnings numbers? The answer lies with consumer sentiment. Many stock prices were priced to perfection, while others have been unduly beaten down in this polarizing market environment.

This brings up two critical points that we repeat on a regular basis. Understanding and internalizing these concepts can help long-term investors consistently position themselves to profit in the long term. These are just two of the things that are critical to your wealthwealth management success.

1. The markets are not merely complicated; they are complex. Meaning there are so many disparate impacts on the markets, one of them being the collective emotions and sentiment of the investing public worldwide, that one should not be surprised but rather expect markets to react contrary to logic on a regular basis.

2. You never go broke taking a profit. Meaning that no matter how sure you are that you are correct about a sector or company, it is generally good practice to skim profits off the top and convert them into income-producing investments through a disciplined, consistent process, with that income to be converted into dollar cost averaging back additional opportunities over time.

There are always explanations for why things happen the way they do; however, the market has a way of humbling the most seasoned investors, so following disciplined, time-tested procedures consistently works for the best investors in the field.

For example, the U.S. relies on materials known as “rare earth metals” for electronic devices, nearly all of which are imported. Since there are few alternative sources, any tariffs would likely be passed directly to consumers. This is one reason the administration has sought an agreement that expands imports of rare earth metals with China, and why there is greater interest in domestic production. This is also why one domestic company moved much higher this past month, rewarding those who understood this issue well.

In contrast, the automotive industry is highly competitive with both domestic manufacturers and many countries that seek to export vehicles to the U.S. If tariffs are imposed on cars from one country, those manufacturers may choose to absorb some of the costs to remain competitive with vehicles from other nations and domestic producers and yet the issue is more complex than that because not all the parts of each foreign car are imported. Vice versa, not all the parts of domestic cars (in fact, not many of those parts) are made here in the United States. So, what is the real tariff cost in the end?

So, in the short run, the effect of tariffs depends on so many different factors that it should not come as a surprise that the impacts have not been as significant as the simple headlines that grab our attention may make them seem, and those impacts vary greatly across industries. It may take several quarters to understand the full effects of tariffs on companies and the consumer, especially as new trade agreements continue to be announced.

Further complicating the issue is that time will only tell how these trade agreements will be fulfilled or even if the promises will be fulfilled.

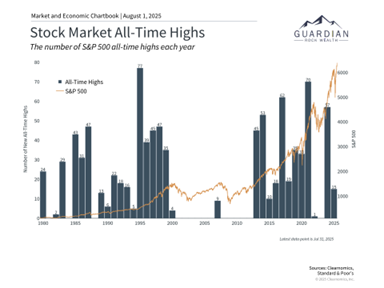

Markets continue to register new all-time highs

The chart above illustrates that the S&P 500 has reached over a dozen new record highs this year, most of which have been achieved over the past month. The Nasdaq has also hit record levels, topping its historic peak from last December, and the Dow is near a new record as well. Although markets at these levels may make some investors nervous, the reality is that major indices can reach many new all-time highs each year during market expansions.

Yet, something we talked about earlier in the year that did not happen as soon as we expected happened today, on August 1st, as we received the non-farm payroll and unemployment results showing significant weakness. Further, previous reports were revised downward so maybe we were not as far off as we thought. We pointed out earlier in the year that the reduction in federal jobs, which also impacts non-governmental jobs, may have a domino effect. Hence, we were not shocked by the decrease in job creation and the tick higher in unemployment.

Where do we go from here?

While tariffs are historically high, what matters more is that they are predictable, or at least more predictable than they seemed in April this year. A stable business environment allows companies to make decisions and adapt their operations and supply chains more effectively.

We continue to expect companies to adapt constructively, but caution that in the short term, the market is likely to continue to experience more volatility than it has over the past couple of months. The same catalysts, the likes of which most of us have not seen in our lifetimes, include the widespread adoption and constructive use of artificial intelligence to power nearly every industry forward faster and more productively. The speed of change shows no signs of slowing down that I can see.

Earnings are a key long-term driver of returns.

Over time, stock prices tend to follow corporate earnings. The accompanying chart shows that while the price and earnings of the S&P 500 do not line up perfectly, they follow broad trends. This is because economic growth boosts earnings, which in turn pushes stock prices higher. So, while the economy and the stock market are not the same, they are closely related. At the same time, it is important to understand the different dynamics of various sectors and companies and not overemphasize the simplicity of a single ratio, such as the P/E or Price to earnings ratio.

We often hear the phrase that a stock or the stock market is cheap or expensive. Whether the stock market is "cheap" or "expensive" depends not just on stock prices or earnings, but in many cases, the earnings potential in an innovative market.

The price-to-earnings ratio is simply the price of a stock or index divided by some earnings measure, such as expected earnings over the next twelve months. This satisfies the need for simplicity, but in our opinion, it tends to cause the cardinal sin of oversimplifying in a complex adaptive market.

Copyright (c) 2025 Guardian Rock Wealth Investment Mgmt Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete, and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.guardianrockwealth.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange-traded funds, or any similar instruments.

Comments