Market Update for May 2025: Aftershocks & Opportunities: What April 2025 Taught Us.

- jbrowning08

- May 6, 2025

- 6 min read

Updated: Jun 5, 2025

May 3, 2025

John Browning, MBA and CSA® | CEO, Principal

Changing the names to protect identities here: Edna is 65 and planning to retire early in 2025. As always, we covered what she planned to do in retirement, and she was looking forward to it. Her previous advisor had invested her retirement funds with 60% Equity mutual funds and 40% bond funds, and she had noticed over the years that she was not getting the growth she had expected. We spoke about how to obtain income without utilizing bonds and increasing the income gradually in an amount that would meet her ongoing needs once she retired. As the April volatility began, she liquidated her equity securities halfway through the month. She let us know that she had decided to pause her investments during this period before we started to work with her, despite our efforts to convince her not to time the markets. Her sizable portfolio took a 17% hit from the first of the year and missed an excellent opportunity to gather significant income opportunities. One more example of trying to predict the market rather than preparing for whatever may come. The good news is that we showed her exactly what we had done with other portfolios during April. While she may need to work several months longer, she understands the power of preparation over prediction before retirement, when the lesson may have been learned too late.

April was one of the most volatile months in history as markets reacted to new tariff announcements that seemingly changed each day or week. However, even though the S&P 500 fell as much as 12% during the month, the index rebounded and closed within one percent of where it started. Recent Gross Domestic Product data also showed that the economy shrank slightly in the first quarter for the first time in three years as companies stockpiled imported goods ahead of new tariffs. We saw bonds again return to trading in tandem with the equity markets. International stocks were also volatile but contributed positively to diversified portfolios. This is another reminder of the importance of staying invested, diversified, and having constant cash flow into your portfolios.

Lessons on staying invested after a volatile month

Once again, April demonstrated the importance of being prepared for market uncertainty. The month began with the White House’s April 2 tariff announcement on nearly all trading partners. These tariffs were far higher than investors had expected, leading to fears of rising inflation, a global economic slowdown, and a trade war. Stock markets reacted with the sharpest declines since the pandemic.

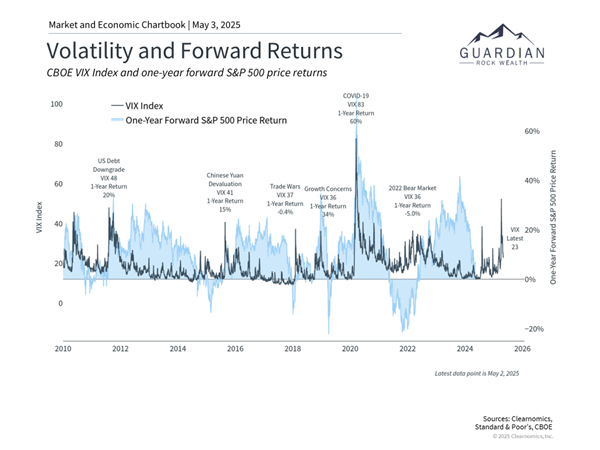

Stock market volatility jumped in April

The administration's decision to implement a 90-day pause for most countries helped fuel a market recovery. Additional exemptions on tariffs with China, including on technology products, further calmed investors' nerves.

Despite significant monthly swings, major indices closed with only modest changes. s. So, while the S&P 500 is still down for the year with dividends, we have just completed nine consecutive days of increases in the major equity indices. Those who continued to use their cash flow to dollar cost average into quality portfolio positions or add even more cash flow tended to come out ahead of the game.

The accompanying chart shows that the VIX index, a key measure of market volatility, briefly crossed 50 for the first time since the pandemic. However, many of the largest declines during the month were followed by significant rebounds. This is a reminder that market swings can move in both directions, and trying to time these moves is usually counterproductive.

Although markets have recently shown signs of stabilization, uncertainty persists. Many, if not most, factors contributing to April's volatility remain and continue to warrant close attention. The situation around trade policy is still evolving, although the 90-day pause suggests that the worst-case scenarios may be less likely. Investors should expect that tariff headlines could continue to drive volatility in the near term. Additionally, we are beginning to see signs of weakness in the unemployment numbers. While the Non-Farm Payroll numbers came in higher than expected on this first Friday of the month, they were still significantly lower than the previous month. Business owners and leaders cannot plan effectively for an environment where change has moved from happening slowly over the years to potentially happening almost daily.

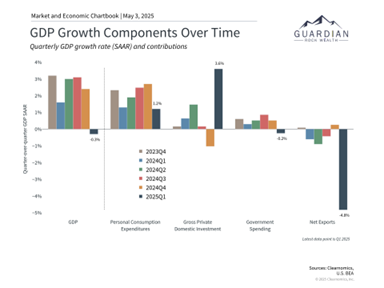

GDP declined in the first quarter

One key statistic may be misleading this quarter is GDP: the GDP, or Gross Domestic Product, declined by .3 % during the first quarter. This was the first GDP decline in three years.

This happened due to a 41% surge in imports, which is a negative to GDP, as businesses hurried to place orders before tariff increases. Further, if you remove the negative impact of reduced government spending, growth was relatively strong during Q1. This has also skewed inventory numbers to the upside. If you were to back out, just the increase in orders over last quarter, GDP did grow in the first quarter. It is also important to point out that this is only the first estimate of first-quarter GDP, and we typically get at least two more revisions before they finalize the number.

Consumer spending slowed but remained positive. Consumer spending is a key driver of economic growth. The latest surveys suggest that consumers expect a rapid price acceleration over the coming year and in the longer run. This, combined with a potentially weaker labor market, lowers consumer confidence. While this has not yet impacted consumer spending or inflation in a significant way, it could be an important factor in the coming months.

The mixed picture of economic growth and inflation makes the Fed’s job more difficult. The central bank faces challenging interest rate decisions in the coming months, and tariffs may increase inflation just as consumers struggle the most. The Fed’s mission is to keep inflation low and lowering interest rates typically increases inflation. This puts the Fed in a difficult position as things continue to unfold.

These events also resulted in unusual bond market swings, although they ended up near where they started at the beginning of the month, with the 10-year Treasury yield at 4.16%. Some investors worried about a flight from U.S. assets, especially with the U.S. dollar falling to multi-year lows however the U.S. Treasury market is so large and is depended on throughout the rest of the world for its yield and relative safety we find it unlikely that worldwide investors would be able to shun treasuries in any great degree as we advance.

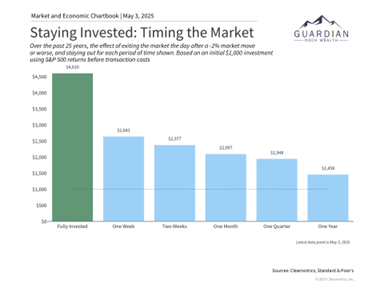

Staying invested has historically been rewarded

In the face of recent challenges, one investment principle remains clear: staying invested through periods of volatility has historically been an essential path to long-term financial success. The accompanying chart demonstrates the potential cost of attempting to time the market every time a 2% decline (or worse) occurs. Since positive and negative days often happen at unpredictable times, exiting the market after negative days, even for a short period, can backfire. The temptation to time the market may be even greater in today's market and economic environment. Interestingly, large professional investors have largely been selling into strength while retail investors have not, which is a negative sign for the overall market in the short to intermediate term. While this seems counterintuitive, you learn it early on from your Wall Street mentors. You can see this when you observe the trading volume as the market moves higher or lower. Institutional professional money managers are participating if the trade volume is relatively higher.

While increased volatility can be unsettling, it’s important to stick to your long-term financial plan, proper portfolio construction, and areas of opportunity. Market volatility often results in attractive valuations across many asset classes, offering potential opportunities for those willing to dig a bit deeper into the analysis.

The bottom line? Market volatility in April reminds us that short-term market swings can occur without notice. History repeatedly demonstrates that disciplined investors who stay disciplined and consistent and focus on their long-term financial plans will be better positioned to achieve their goals.

Copyright (c) 2025 Guardian Rock Wealth Mgmt Inc., All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but it is not necessarily complete, and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.guardianrockwealth.com or affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should NOT be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy.

Comments